Energy markets are receiving fair bit of airplay over the past few days as tensions in the Middle East have materially escalated and this morning one of Australia’s largest companies, Oil & Gas producer Santos Ltd (STO), has received an all-cash bid of $8.89 per share from Abu Dhabi National Oil Co (a state-owned company). Let’s address a few issues.

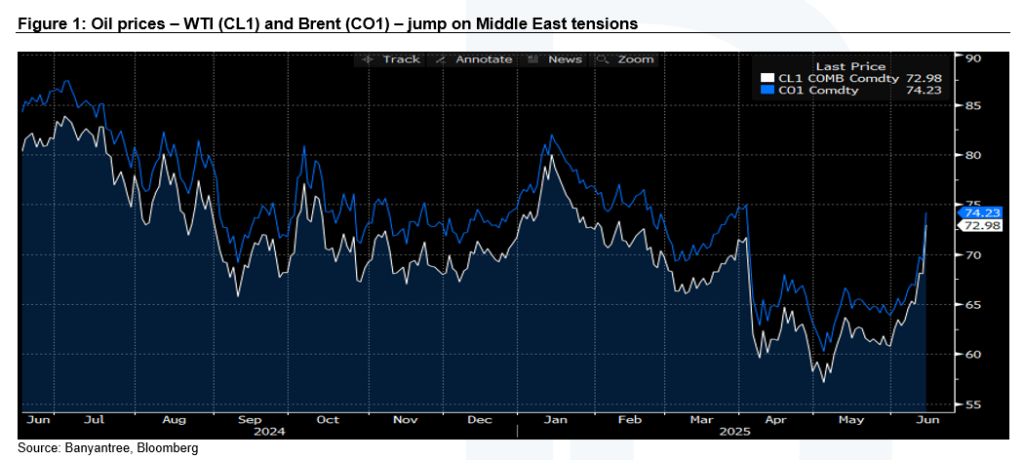

Geopolitics and oil / energy prices – is it just noise? As we wrote in our weekly equity strategy report published this morning, global oil prices have jumped since the start of Israel’s strikes on Iran, which the Iranians have responded to. At this stage we struggle to see an off-ramp which could provide a quick diplomatic resolution to this ongoing saga in the Middle East. The movement in oil prices indicates investors could be fearing prolonged disruption to oil markets – particularly the Strait of Hormuz which is controlled by Iran and is a material supply choke point for global energy markets. We continue to monitor the situation and highlight that across our portfolios (multi-asset & equity strategies) we have exposure to energy stocks which are benefiting from this spike.

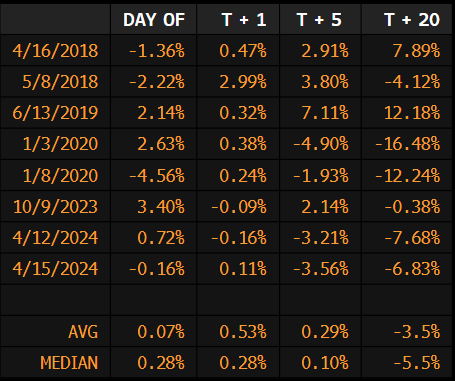

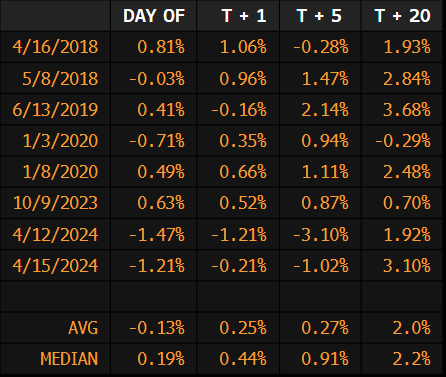

HOWEVER, analysis of similar past events also suggests the spike in oil prices tends to fade out relatively quickly. The analysis looked at how oil prices and S&P 500 Index performed during previous episodes when Iranian geopolitics were involved (e.g. 2018 Trump ripping up nuclear agreement, 2019 Iran’s alleged bombing of an oil tanker and 2020 assassination of top Iranian official Soleimani). Table 1 below shows the price movement in crude oil contracts around episodes Iran was part of the narrative. Table 2 does the same analysis but for movement in S&P 500 Index around these episodes.

Table 1 – Crude oil contracts = after initial price volatility, there is no real correlation between the episodes and direction of price 1 week or month later.

Table 2: S&P 500 index = while there is some positive correlation over the short term (day / week), over the medium term (months ahead) it fades.

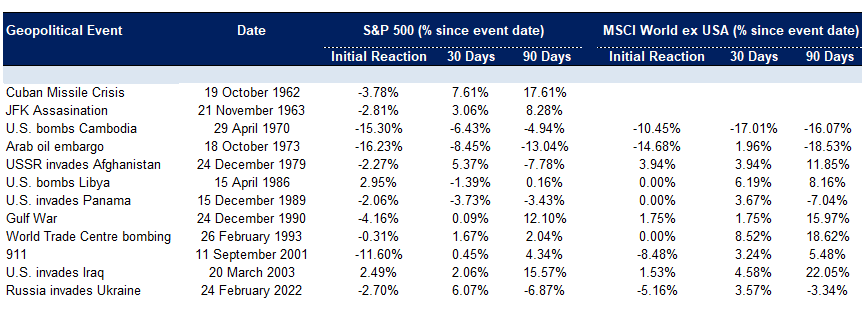

Now let’s zoom out and look at more broader geopolitical episodes in the past, not just Iran related. Whilst not exhaustive, the list below provides some historical geopolitical events and markets’ reaction to them (S&P 500 & MSCI World Index ex US). Worth keeping in mind, no two events are alike and economic / earnings impact does vary.

So broadly, while we continue to monitor the situation closely and our portfolios (multi-asset & equity strategies) are benefiting from these tensions, the impacts from geopolitical events do not – as the historical data suggests – linger for too long or are mixed in our view, all else being equal.

Santos Ltd (STO). This morning Australian oil & gas producer STO has announced it has received an all-cash bid from a unit of Abu Dhabi National Oil Co. Adnoc, a state-owned company, for US$5.76 (or A$8.89) per share, which is a 28% premium to Friday’s closing price. Santos stock has risen in recent months on speculation that Middle Eastern energy producers including Adnoc and Saudi Aramco were studying potential bids for the Adelaide-based company.

Despite STO being a key position in our portfolios for many years, we have held it on a Neutral recommendation for the most part and only recently upgraded the stock to a Buy on 21 November 2024 (attached for your convenience) & reiterated in March this year – now obviously a very timely call! This should give our clients confidence our bottom up efforts are genuinely trying to find the best investments, our recommendations truly try to reflect that and we are not “spruiking” names because we own them. This is also true for our Managed Funds / ETFs recommendations. We hope this is a good reminder why clients come to us for a truly independent and extensive research program.

Thoughts on the bid. We have always said STO is likely to be a takeover play (see our equity report – Investment Thesis, Risks & Company Description page). However, we want to highlight to clients that given the multi-polar world we now face and race to secure energy assets, the probability of a foreign state-owned company purchasing key energy assets in Australia has a high probability of being knocked back by the Foreign Investment Review Board (FIRB).

Recall APA Group’s takeover bid from CKI was knocked back (see below) – we spoke with CKI in Hong Kong a few years ago and they said the regulatory environment for M&A was very tough in Australia. Further, as we highlighted above, all else being equal, history shows that oil price spikes on the back of geopolitical events tend to fade. STO just got the perfect storm – geopolitical risks spike and a bid! We would encourage clients to take some profits.