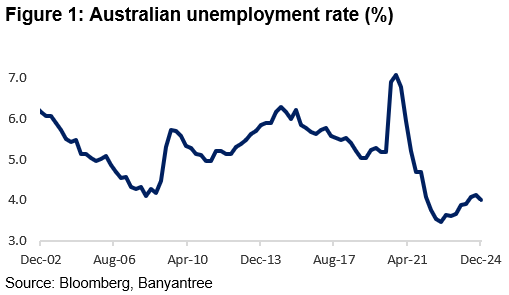

Labour market remains resilient

In line with market expectations, the latest Australian jobs data showed Australia’s unemployment rate at 4.0% as of December 2024. On a positive note, employment increased by 56,300 which was well ahead of expectations of 15,000, however this was driven by part-time jobs which may be perceived by the market as lower quality.

We believe the labour market remains healthy and tight in Australia given full-time employment has been the major driver of employment gains over the past year. Whilst the overall Australian economy remains sluggish, the solid employment data will add to the Reserve Bank of Australia (RBA) headache. It does complicate the picture as the market expects the RBA to begin their easing cycle with most expecting a rate cut at the April meeting. The latest employment data in our view could see the RBA remain on pause at the February meeting.

However, consumer confidence is weak…

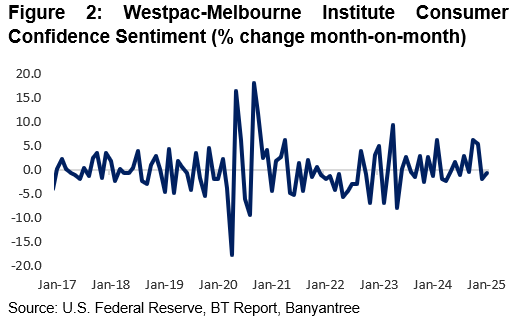

Australian consumer confidence recovered a little in January 2025 but declined in December 2024. The December decline was likely driven by persistently elevated inflation, high interest rates, and global macro uncertainty (raised by the political turmoil in several countries). The survey in December also showed consumers concerns about the domestic economy and housing market.

Consumer spending remains robust

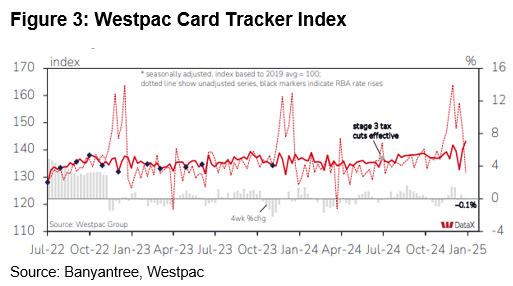

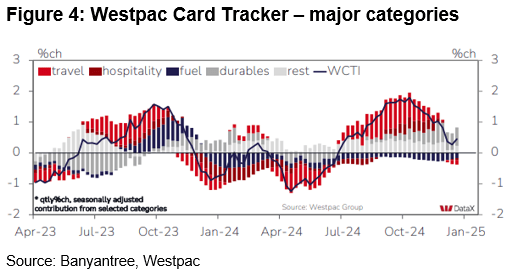

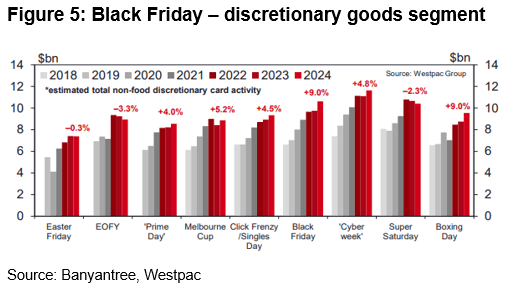

Despite Australia’s sluggish economic growth and weak consumer confidence, we would characterise consumer spending as robust. According to Westpac card tracker data, trading over the Christmas and New Year period was robust. Below we have provided key insights from Westpac’s latest card data:

“The Westpac Card Tracker Index [based on millions of credit and debit card transactions processed by Westpac] has seen a very choppy performance through the Christmas-New Year period. While stronger-than-usual card activity over the Boxing day and New Year weeks has lifted the index to a new high, this followed a steep drop in the week just prior to Christmas. At 143.2, the latest index read is 1.4pts above the peak seen at the start of Dec.”

“By category, the trends evident in mid Dec have extended through year-end with the waning growth in the hospitality and travel segments turning to a slight dip and fuel continuing to exert a slight drag. Durables are now almost single handedly driving growth, card activity growing at 2%qtr in this segment compared to a 0.5%qtr contraction across all other segments combined. Note that all of this is over and above regular seasonal variations which are typically a large positive for this segment in the December quarter.”

“‘Black Friday’ was a roaring success, activity in the first week up 9% on the same period in 2023 and a solid 4.8% gain in the ‘cyber week’ that followed. This was despite a clear ‘jump start’ to this year’s sales. Activity in the week prior to the Black Friday week were up 7.8% on last year.”