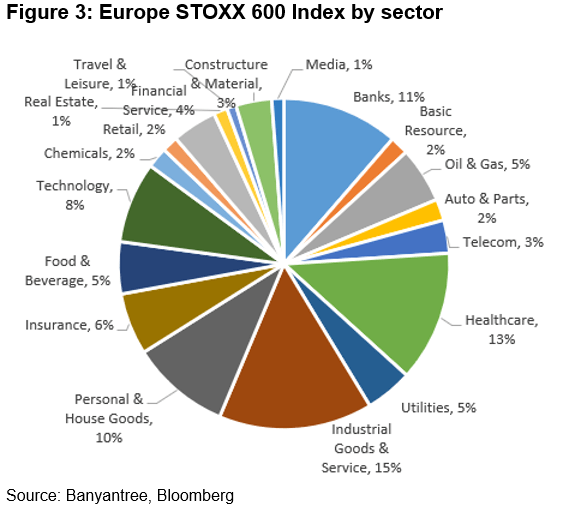

European equities are increasingly gaining favour among global investors at the expense of U.S. equities. Funds flow data and recent performance point to this fact. The question is whether this trend is sustainable? Europe’s STOXX 600 Index has experienced a sustained, long underperformance relative to U.S. equities (S&P 500 Index) since the global financial crisis. There have been periods since the GFC where this trend appears to be reversing, but after a short time U.S. equities reinstated their dominance. Year-to-date 2025 performance again suggests the tide may be turning in favour of European equities.

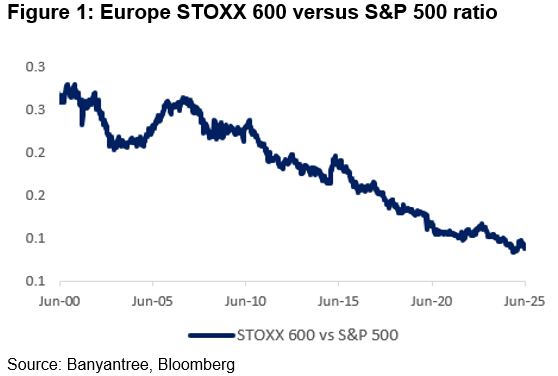

A weaker U.S. dollar (USD) is generally consistent with ex-U.S. equities outperformance. Historical data suggests investors looking for evidence of a sustained outperformance in global equities outside of the U.S. will need to see the U.S. dollar trend lower from current levels. It is a well understood fact that a lower USD is positive for ex-U.S. equities and assets – including European equities. A lower USD acts like a liquidity injection given costs and debt are often priced in USD and therefore often contributes to ex-U.S. assets outperformance.

The charts in figures 1 & 2 succinctly capture this. The last time European stocks sustainably outperformed U.S. equities was from 2002 to 2008, a period which saw a material decline in the U.S. dollar – the DXY index declined from highs of ~120 in early 2002 to lows of ~71 level (i.e. ~41% decline). It is clear U.S. President Donald Trump and VP JD Vance want a lower USD to make U.S. produced products and manufacturing more competitive globally. Despite the other unintended consequences of this strategy, on face value an U.S. administration trying to drive the USD lower is good news for ex-U.S. assets and returns, all else being equal.

Positioning in U.S. assets is overstretched and will likely see some rebalancing. Regardless of whether the U.S. is a good investment or not, it was painfully obvious that U.S. assets were overbought, at the very least in the short-term, and valuations overstretched. Before readers accuse us of being “harry hindsight”, we would note that we have been materially underweight U.S. equities in our global core equity strategy (~38% in U.S. equities versus benchmark ~71%) and held elevated cash levels. Part of the overstretched market’s exposure to U.S. equities has to do with being benchmark aware – something we have never subscribed to. As of May-25, the U.S. accounts for 71.46% of the weight in the MSCI World Index. This is up from around 53% in 2000 – thanks to the abovementioned outperformance and subsequent capital flows. Hence a benchmark aware global equities fund manager would need to hold a substantial allocation to U.S. equities even if they wanted to express an underweight position. In our view, just based on increased risks in the U.S., a level of rebalancing away from U.S. assets is warranted.

A few trillion dollars could be material for European equities. The current market capitalization of the S&P 500 Index is approx. US$52tr versus STOXX 600 Index US$14.9tr. Given the large disparity in numbers, incremental flows out of the U.S. (say $5tr in market cap) could result in material uplift in Europe’s market cap (additional $5tr flow equates to ~34% increase in STOXX’s market cap).