QUESTION 1 – Oil markets are in contango. What do you make of this – excess supply concerns or demand concerns which, reading between the lines, could be signaling increasing recession risks?

Firstly, we consider many indicators when looking for cues on impending recession risks and of course oil is a widely followed one. With oil specifically, which I know you would appreciate, there can be many more themes driving the oil price other than supply/demand dynamics. There are so many financial instruments linked to the oil prices (I think it may be the most traded commodity?) which are expressing so many different forward investment views – economic risks, supply/demand dynamics, Non-OPEC (e.g. shale production output) vs OPEC (changing relationships within OPEC), geopolitical risks (sanctions etc), structural changes (EV demand outlook etc). So it’s not an indicator we place the largest weight on in macro research.

Having said that, we think the current contango curve structure is reflecting several views in the oil markets – geopolitics (could argue prices should be lower without this premium) + excess supply (market appears to be focused on this from what we can tell) and demand weakness (we think China could be the focus here). Few observations for consideration:

Trade tensions between China / U.S. (and more broadly tariffs since April) are definitely playing into the demand weakness narrative. Both China / U.S. are material consumers of oil. Only recently Reuters reported that China was looking to add at least 169 million barrels of new crude oil storage capacity across 11 sites in 2026. So China can provide material support for the oil price (& opposite is also true!). But in support of your point of potential economic weakness ahead, we think economic growth in China over the coming quarters (4Q25 / 1Q26) warrants close watching.

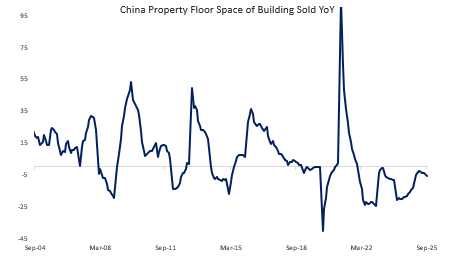

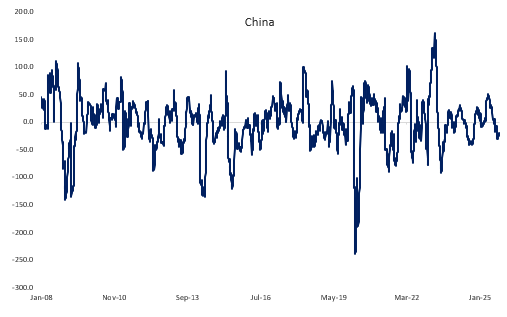

Recent discussions in Asia suggest China’s growth will slow down in the coming quarters (moderating demand which was pulled forward on tariff risks in 1H25). The rate of moderation is what we are more interested in. For example, the property market in China appears to be weakening again (chart below – YoY change has turned down) and the stimulus which provided a boost in 2H 2024 is waning. Policymakers are aware hence liquidity (as measured by M2 supply) is increasing which is a positive (chart below). In our view, Chinese policymakers are trying to support consumer confidence (and therefore spending) by boosting the wealth effect through the stock market given a turnaround in the property market remains difficult and long-dated.

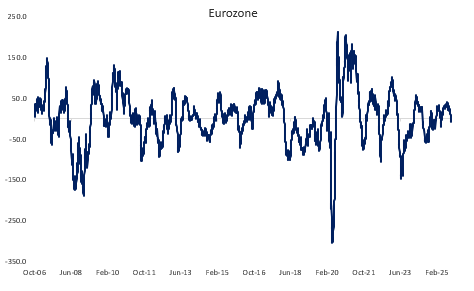

Another way to highlight our more cautious view on China over the coming quarters is by looking at the Citi economic surprise index charts below – the indicator has turned negative for China and Europe (it’s biggest trading partner) (i.e. incoming economic data is coming in below expectations).

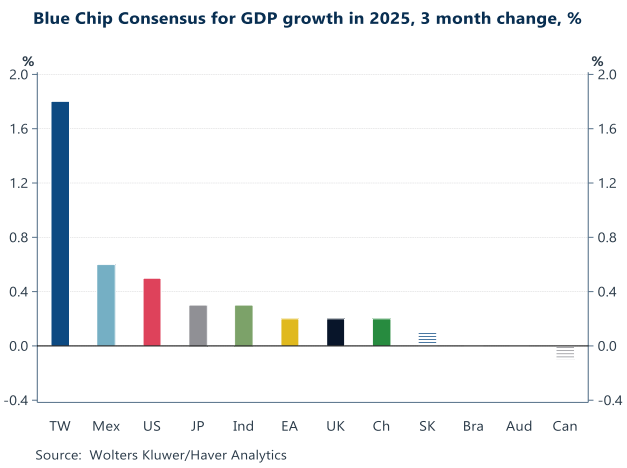

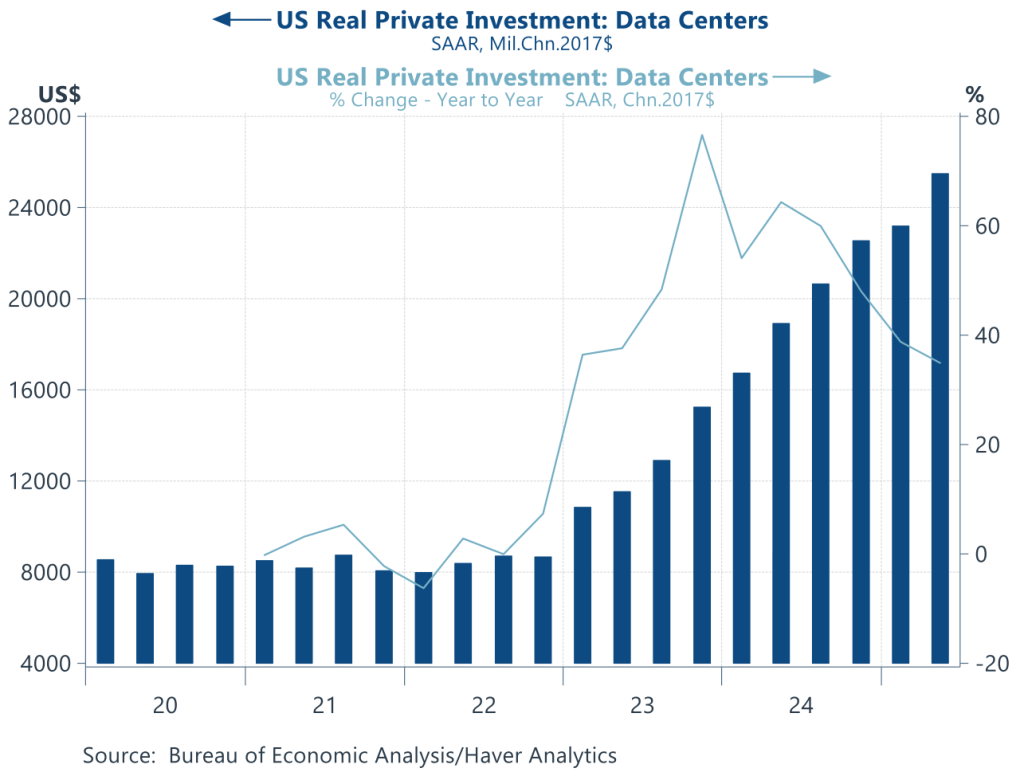

To be clear, our view on China is one of caution rather than activity falling off a cliff. But right now economic growth is still holding up relative to expectations. Just yesterday China’s 3Q25 GDP numbers (+4.8% YoY) came in ahead of estimates +4.7%. More broadly, global economic estimates are still holding up – Blue Chip forecasters have actually increased their 2025 growth estimates over the past 3 months. In the U.S., GDPNow estimates for 3Q25 GDP growth is currently at 3.9% – with U.S. growth benefiting from the AI tech build out (see chart below). On corporate earnings, while the 3Q25 quarterly earnings season has only just kicked off, earnings growth current run rate is ~15%.

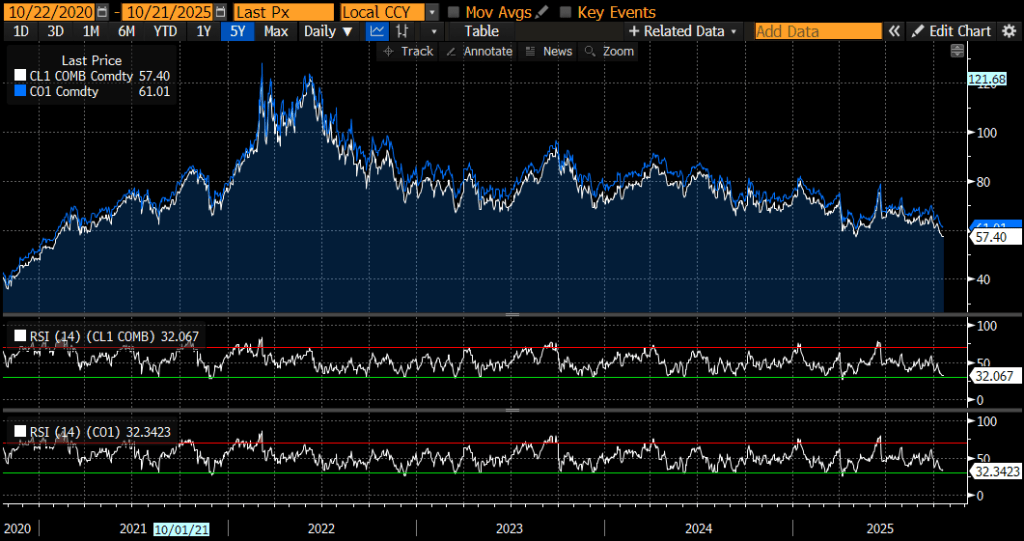

We would suggest that oil prices could actually be much lower (closer to US$50/bbl?) if it wasn’t for geopolitical tensions (war in the Middle East + Ukraine / Russia). We appear to have a ceasefire in the Middle East and President Trump recently announced that he would have a 2nd meeting with Vladimir Putin in the coming weeks (also pushing Ukraine to make a deal (or compromise) with Russia). It will be interesting to see how oil prices react if President Trump gets a ceasefire or some sort of resolution – it could very well drive oil prices lower if we are correct.

The reason why we think oil prices would be lower in the absence of a geopolitical premium is the oversupply narrative, which has received a lot of airplay. All else being equal, the supply picture looks very uninspiring for oil prices. The International Energy Agency raised its 2026 global oversupply estimates by ~18% and U.S. storage brokers are noting a surge in demand to secure tank capacity at Cushing, Oklahoma (this is probably driving the contango curve).

The weakness in oil prices is actually a negative for the U.S. shale industry, which industry estimates suggest requires a price above US$60/bbl for new drills to be economically viable. This suggests that if the marginal players start to cut / delay growth projects, a supply squeeze may actually see future prices well supported.

Over the very near-term, oil actually looks oversold on technical basis (RSI) and could see a near-term bounce. But we would suggest the trend remains lower.

Our positioning: Very high level, we have recently switched to tactical underweight U.S. equities (call is somewhat going our way with the recent increase in vol), taken profits on Chinese equities after a very strong rally and added to our downside buffers within our multi-asset strategies (increases alts). Within equities we continue to hold good levels of cash.

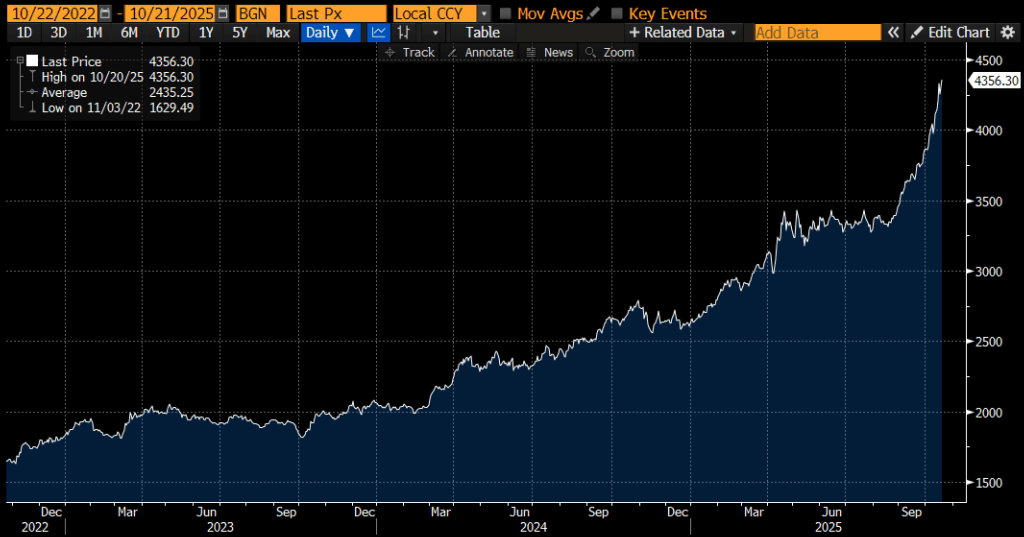

QUESTION 2 – Gold price has gone parabolic …I have many clients in GOLD ETFs…Quite a few have the gold miners ETFs…Do you think we should be cautious and avoid adding for now or just treat it like any other investment and take profits from time to time?

As our clients know, we have been pushing the bullish gold trade (when it was around US$1,800 level) for many years and continue to hold positions in gold miners & gold ETF across our equity & multi-asset mandates. However, any asset price that experiences a parabolic price rise over a very short period, should be a signal for investors to pause and take some profits. Our medium term view hasn’t changed on gold and, on balance, we continue to see a supportive environment for gold prices. We see the demand from global central banks and investors seeking to diversify away from U.S. assets as supportive of gold prices. No global central bank – with most already well (perhaps over) exposed to U.S. assets / dollar – will be looking to increase their exposure. In fact, we think the global central banks will continue to divest and reduce exposure.

The above doesn’t mean the gold price cannot turn lower (could dramatically decline as well!) or something breaks down with our medium term positive thesis. Keep in mind gold doubled in 1979-80 and 2010-11, before falling after these significant price appreciation episodes. Therefore, we continue to advocate profit taking along the way.