A market correction had to come at some point! Both the S&P 500 (-2.7%) and NASDAQ (-3.5%) sold off aggressively on Friday after U.S. President Donald Trump threatened China with massive increases in tariffs. He further threatened to cancel the upcoming meeting with China’s President Xi Jinping in South Korea. What did China do to attract the latest wrath? China has announced several policies including new curbs on exports of rare earths / critical minerals, new port fees on U.S. ships and started an antitrust case against U.S. company Qualcomm Inc.

China explains the curb on rare earths and other critical minerals

President Trump appears to have taken issue with China’s new curbs on exports of rare earths and other critical minerals. China at present processes around 90% of the globe’s rare earths, which go into everything from smartphones to solar panels. China is implementing new licensing requirements for exporters who source certain rare earths from China, with Chinese authorities citing national security for the changes. However, before these measures were announced, China did notify the relevant countries, which explains the “sending letters throughout the World” part of President Trump’s tweet.

China expects minimal impact

It looks like China has already tried to de-escalate the tensions over the weekend, with China’s Commerce Ministry noting on Sunday that the announced export controls were not a ban on exports and that applications which meet the regulations will be fulfilled. China further said that it had already assessed the potential impact from these new measures on the industrial and supply chains. China expects the relevant impact will be “very limited”. But, in our view, it will be disruptive because effectively you need China government’s approval to export products with even the smallest number of rare earths (0.1%) and must explain why.

Thoughts on market correction

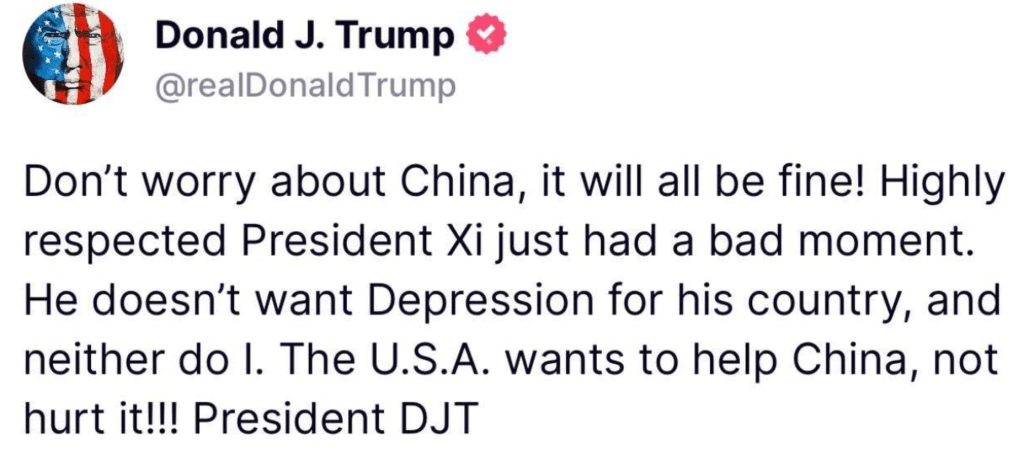

The markets may be volatile this week as the news is fully digested across global markets of how real President Trump’s latest threat is. Also keep in mind the U.S. bond market is closed on Monday, which means the reaction in the rates market will take another day. As always, both the U.S. & China has left some room for de-escalation – China on Sunday and now President Trump with this:

Expect U.S. equity market futures to jump on the back of this!

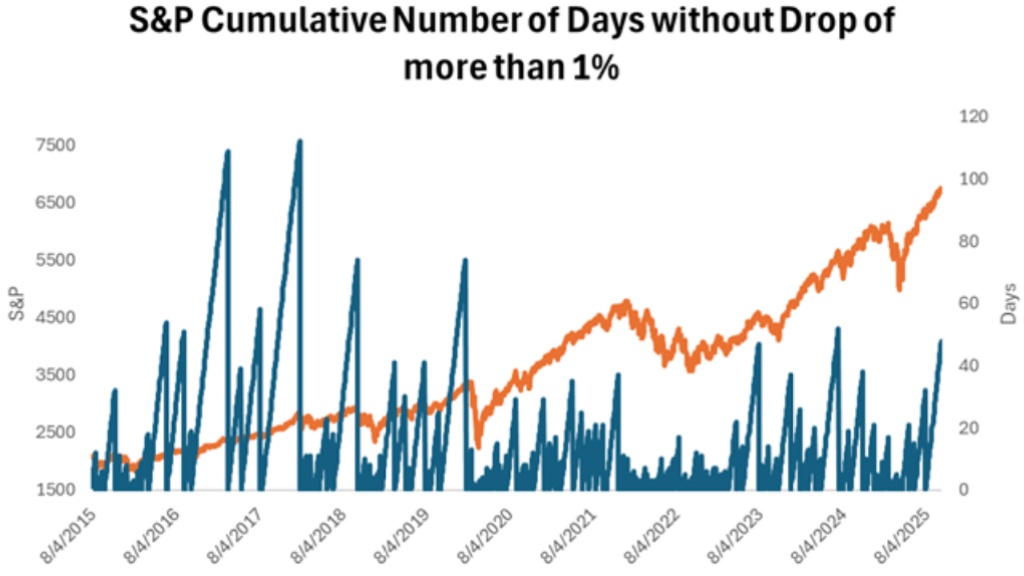

However, over the long-term we suspect both sides need to find a healthy middle ground, with the alternative presenting a very bleak picture for the global macro. In any case, what we were expecting in September, may well play out in October – that is, a correction of 5-7%. Keep in mind the S&P 500 has gone almost 60 days of trading without a >1% move – the longest period of stability since January 2020. Hence, forced deleveraging (?) and general profit taking may take some time to work through the markets.

Reminder – we recently downgraded U.S. Equities to an underweight on a tactical basis (see our Global Asset Allocation table) expecting a correction in Sept / Oct.