The latest Australian inflation data is only likely to increase investors’ expectations for the Reserve Bank of Australia (RBA) to cut the RBA cash rate further in the current easing cycle. Australia’s consumer price index (CPI) for all groups increased +0.7% for the June 2025 quarter or +2.1% on an annualised basis.

The more closely monitored trimmed mean measure of CPI was up +0.6% for the quarter and is up +2.7% on an annualised basis, which is within RBA’s target range of 2-3%. The trimmed measure is a better view of underlying inflation as it reduces the effects of irregular or temporary price changes that can impact the CPI. The latest trimmed mean inflation data was largely in line with market expectation and below previous quarter’s reading of 2.9%.

Will the RBA cut in August?

Recall the prospects of an RBA rate cut in July gathered a lot of momentum ahead of its meeting. But the RBA surprised everyone by keeping the cash rate on hold. However, with two consecutive quarters of inflation reading within their target band of 2-3%, the RBA can focus on supporting economic growth. The global economy continues to have its challenges.

Recently the Organisation for Economic Cooperation and Development (OECD) lowered its global economic growth forecasts for 2025 by -0.2% to +2.9%, which included a downgrade to U.S. growth by -0.6% to +1.6%, Australia down by -0.1% to +1.8% and China down by -0.1% to 4.7%.OECD blamed the downgrade to U.S. President Donald Trump’s trade policies, noting the impact of tariffs and uncertainty on confidence and investment.

More specifically in Australia, recent labour data showed a surprise uptick in the unemployment rate in June to 4.3% from 4.1% in the prior month. Put together, we now believe the RBA should cut the cash rate in August.

Positive developments on the U.S. tariffs front

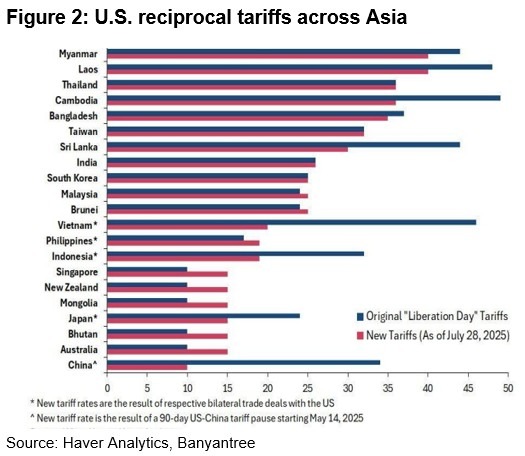

The U.S. continues to make progress on securing new trade deals with trading partners across the globe, with the U.S. recently announcing trade deals with the European Union (EU) and Japan. Along with securing new deals, and therefore reducing some of the uncertainty, many of the recently announced tariffs are lower than what was originally announced on “Liberation Day” in early April.

For example, the U.S. had threatened Indonesia with tariffs of 32% originally, however the two nations have now reached an agreement that has seen tariffs come down from 32% to 19%. Similarly, as of the latest developments, Japan’s tariffs have reduced from 25% to 15%. While this is not true of every country, broadly U.S. President Donald Trump’s tariff bark has been more brutal than the bite itself. Tariffs talk with China remain afoot but both sides appear to be making good progress towards a deal.

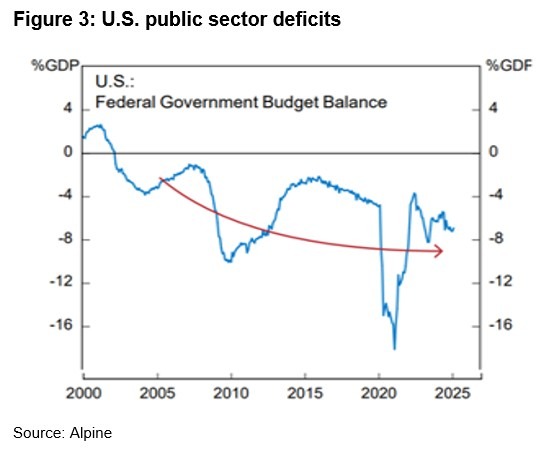

Global fiscal thrust. As we have been arguing for some time that, all else being equal, if governments continue to persist with aggressive spending plans, then that is likely to be supportive of corporate profits and therefore equity markets. Fiscal deficits across key regions – the U.S. (see figure below), Europe, China, Japan – have increased over the recent years. More specifically, the U.S. government has been running budget deficits of 6-7%.

While the U.S. President Donald Trump campaigned on lower budget deficits, spending cuts and fiscal constraints, the trend points to similar levels of spending going forward under his second term. Even the traditionally conservative Chinese policymakers have moved towards developed market style stimulus policies to support their economy. While there are other consequences for such spending largesse (e.g. higher bond yields to punish governments) over the long-term, major regions running budget deficits of 7% or more over the near-term should be supportive of global economic growth.