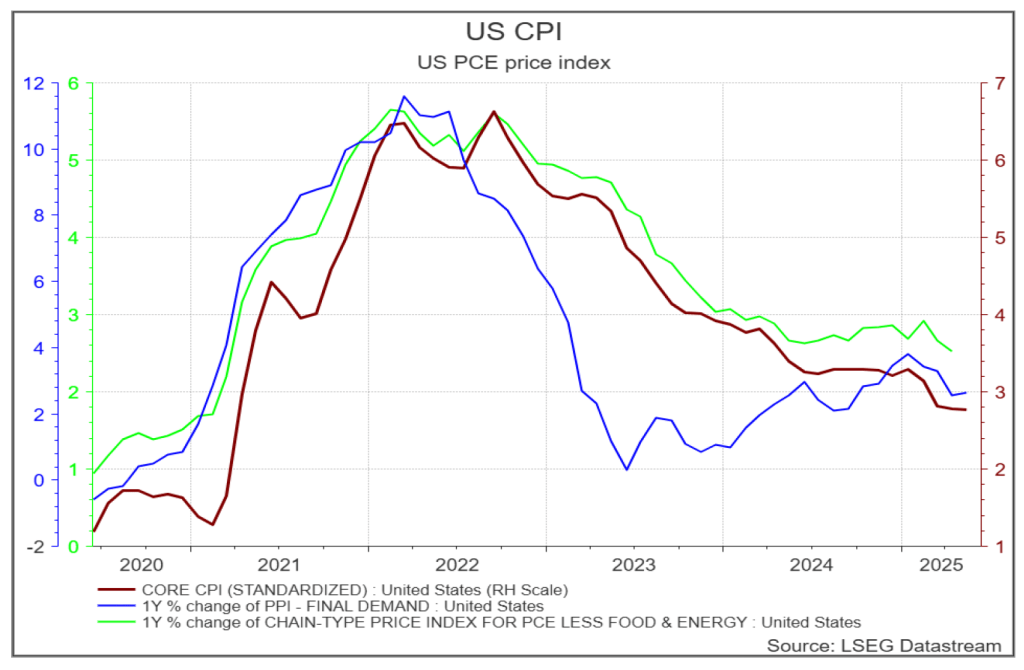

Last week’s US CPI was largely ignored by the markets – just as well. The data is currently distorted by the inventory tariff related build up and the ongoing tariff uncertainty.

It is our view that, fundamentally, US markets and by association all global asset markets are rapidly approaching a day of reckoning. None of the risks we’ve recently highlighted have expired or even moderated.

– Geopolitical risks (Taiwan, Panama, Greenland, Ukraine, Israel)

– Tariff Policy uncertainty.

– US budget outcome uncertainty with the US debt ceiling fast approaching again

– Rising inflation risks linked to the recent disruption to global trade from the tariff uncertainty.

– The role of the USD as the global reserve currency diminishing

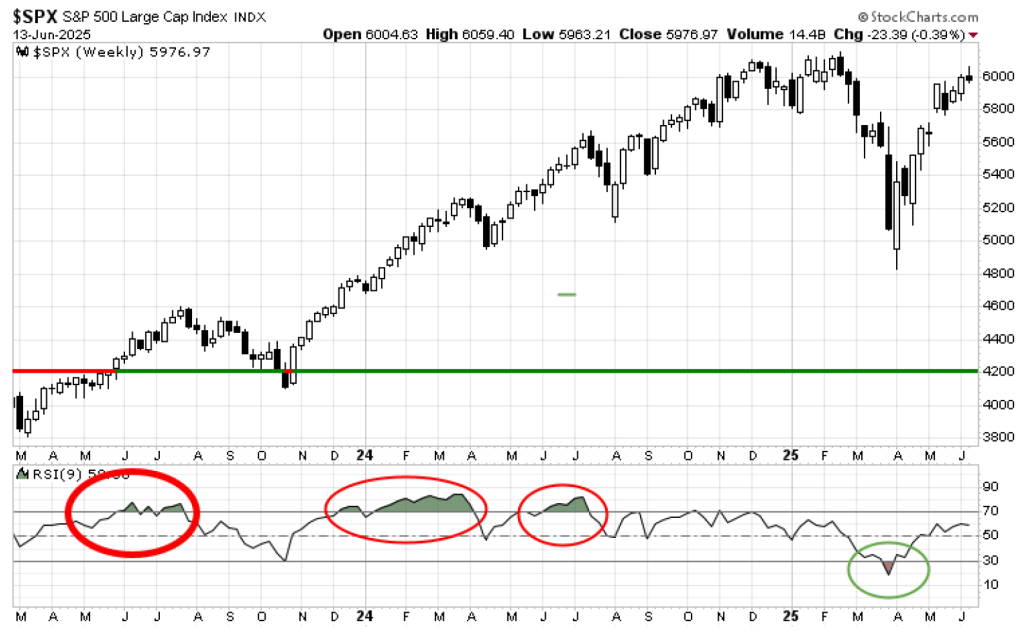

Against this, the S&P 500 and in fact all US equity indices are on a ‘technical basis’, set to first test the previous highs and then surge, potentially a lot higher. The phrase ‘irrational exuberance’ has never been more appropriate. This will be an equity market where ‘letting the profits run’ and employing a strict trailing stop loss will work every well. In an outlook where bond yields are expected to keep rising the only place for a US investor is in growth equities.

The first test then is the previous high recorded on the 18th of February 2025 at 6147.43. Once this level is breached it becomes an important support level and a stop loss point. As the index trades higher the stop losses trail upwards. Watch for the RSI to move above 70.

Interest Rates

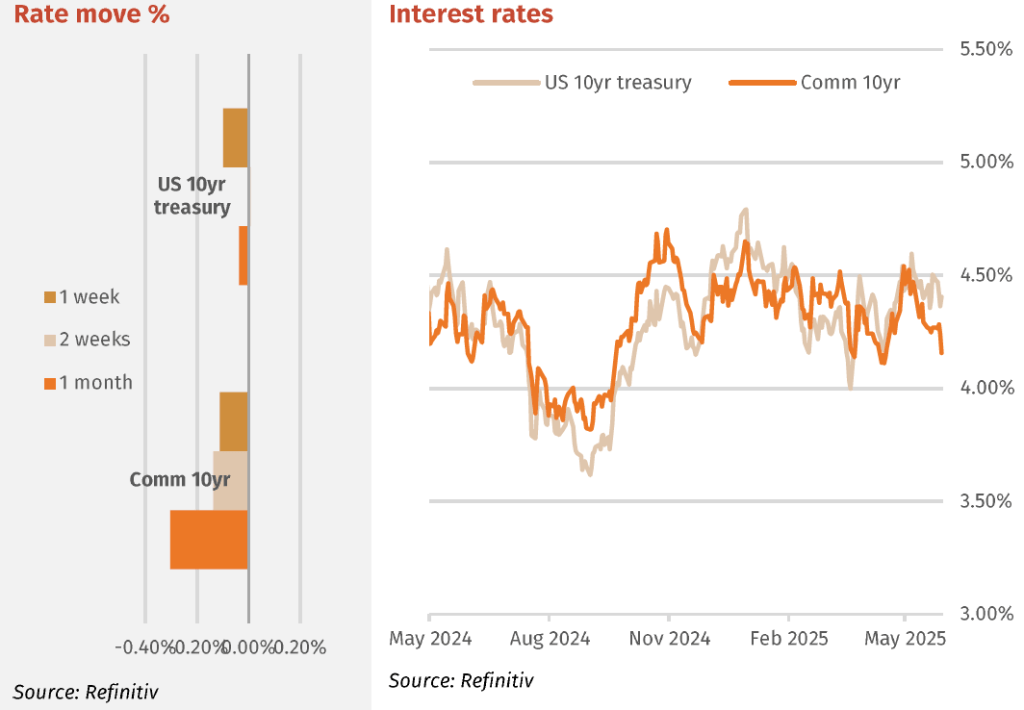

The economic data last week hardly moved markets but the Israeli attack on IRan’s nuclear enriching facilities late in NY trading on Thursday and into Asian trading on Friday produced dramatic swings. The 2-year swung from 4.05% down to 3.88% before closing at 3.96%. The 5-year from 4.13% down to 3.91% and closed at 4.01%. The 10-year 4.51% down to 4.31% and closed at 4.41%. It remains our view that yields at the 5-year plus part of the curve will test 5% later in the year.

Australian bonds tracked changes in the us yield curve all week. Our bond market is now a beneficiary of offshore funds flowing into Australian dollars looking to avoid U.S. dollar exposure, despite rising sovereign risks highlighted recently by rating agencies. 10-year comm. Gov. bond closed in Australia at 4.757%, a 2-month low, however this yield should

rise on Monday after New York’s Friday night bond yield rises. Nevertheless, Australian bonds are trading at a decent discount to comparative US rates.

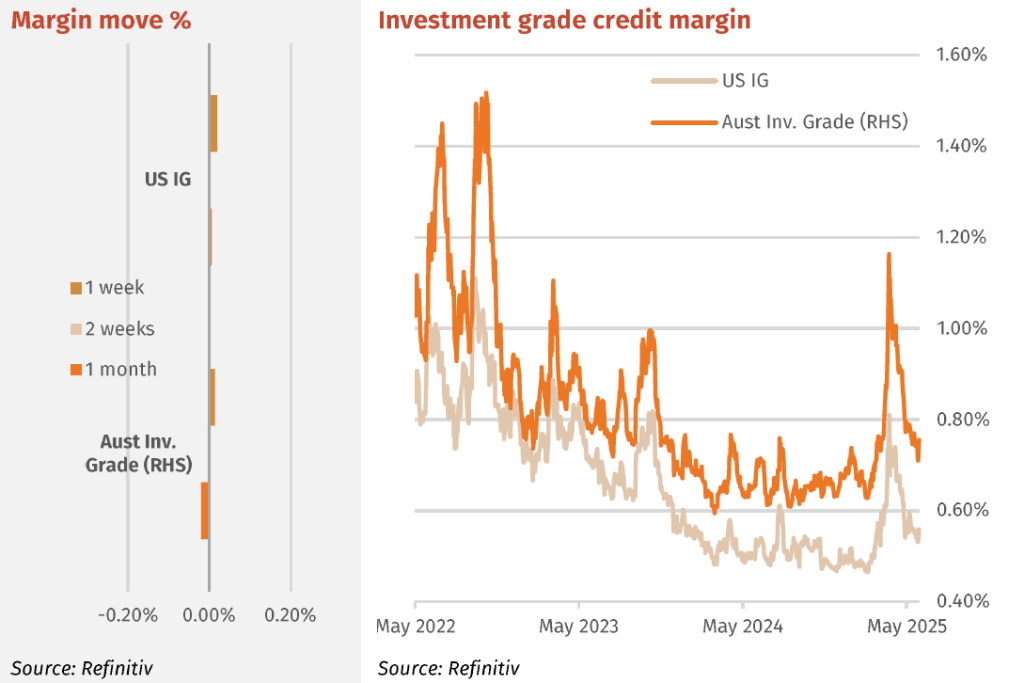

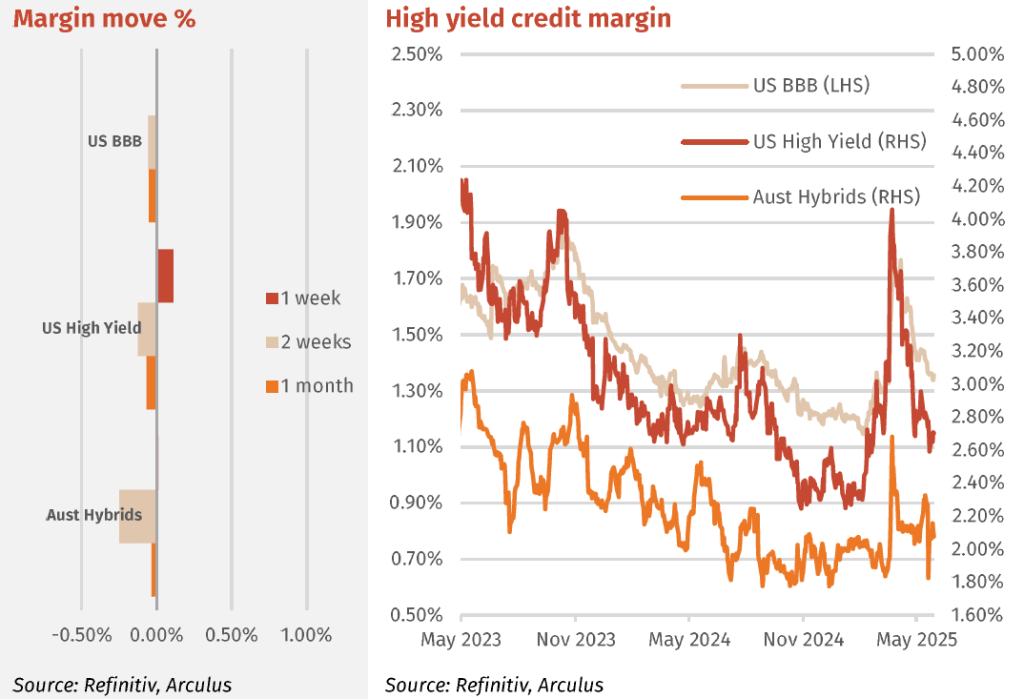

Major Credit Markets

US Investment grade (IG) bonds are steady to strong in past weeks. The average IG bond margin has tightened by 3 bps to 0.88%. “BBB” rated in 5 bps.

In Australia last week there was a new record set for bond issues. The market has coped very well with this supply. Unfortunately, the la rge IPO books have not translated into margins tightening in the secondary market. We expect that major bank supply will now be limited into June 30 but also expect that offshore kanga issuers will keep coming back to Australia because margins on senior and T2 here tightened by more than in other developed markets. Last week Barclays came with a Senior bailable bond 6-year non call 5-year priced at +1 65bps. This is a common type of bond in Europe but is rarely seen here in Australia since APRA don’t recognize the Senior Bailable bond structure (upper Tier 2). It is not a bond type that is well understood by Australian market participants. The rating

agencies apply the same rating as they do for Senior non-bailable bonds.

High Yield Markets

Global High Yield (HY) spreads mainly fell over the week with sub sectors such as automotive, insurance and utilities strong. “BB” rated bonds are on average at a margin of 7.82%, in some 0.15% over the past 2 weeks. In contrast for “CCC” rat ed bonds, margins have widened by 0.27% in recent weeks to be on average at a 9.23% margin. However overall, HY margins have tightened by 0.14%. Hence “CCC” are moving against the sector trend.

Hybrid markets were steady from the previous week despite some weakness intraweek. The ex-div effect where franking cred its tend t o get held (in other words the price ex-div only falls the cash amount not the value of the associated franking credit) washed out in recent sessions. The major bank average hybrid margin is at 2.08% smack on it average for 2025. Volumes also have retreat ed to average levels, spread reasonably evenly across the curve with some elevation is the long dated AN3PLK and WBCPM.

Listed Hybrid Market

Hybrids -relative update to bank senior and sub notes.

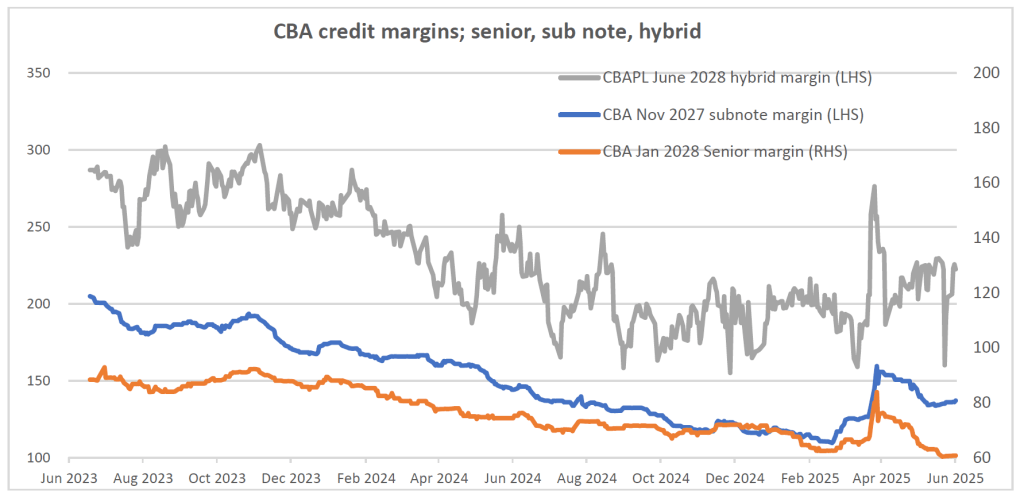

After the recent bout of volatility and potentially a rehash of such in the coming weeks, we check in how hybrids are faring vs senior and sub notes. A good method to examine this explicitly is to show the margin of a CBA senior, sub note and hybrid, all with similar maturities. The first chart shows the trading margins for the CBA Nov 2027 senior bond, the CBA Jan 2028 maturity sub note and CBAPL which has a maturity of June Firstly, note since July 2023 the downward margin trend for each security, expected as maturity is coming. More recently in April the margin rises for each and then the recovery. In past weeks the hybrid and sub note margins have trended back up, however the senior margin

has re mined steady. The hybrid margin shows much variation over time (the down plunge in early June was the ex-div effect where the franking credit was held in the price, quickly reversed) which would also show up in a relative valuation. This is shown in the second chart.

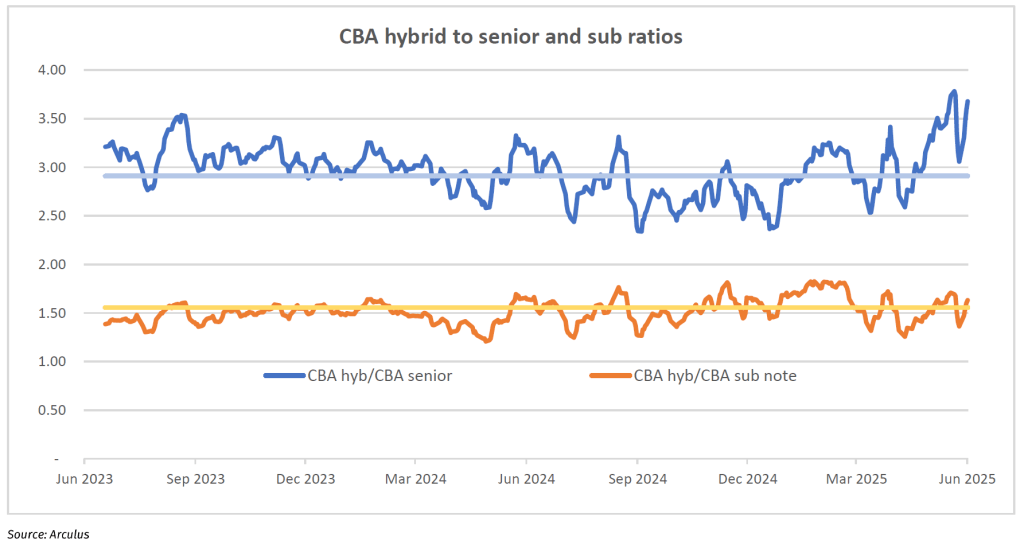

The second chart below shows the CBA hybrid as a ratio to the each of the CBA senior and CBA sub note. The blue line of the hybrid to the senior bond shows the hybrid is cheap relative to where the ratio has previously t raded, especially in the past two months. The orange lines show the hybrid margin relative to the sub notes. As shown, this looks to be about far relative to the ratio’s history. Where does this put us? The rising sub and hybrid margins show risk is being priced in, whereas this has not yet the senior bond market. Perhaps t hat may change this week. However, without a jump in market volatility, CBAPL is trading good value relative to CBA senior bonds.

Forward Interest Indicators

Australian rates

Swap-rates move in line with bond rates.

Swap rates:

– 10-year swap 4.13%

– 7-year swap 3.88%

– 5-year swap 3.64%

– 1-month BBSW 3.74%