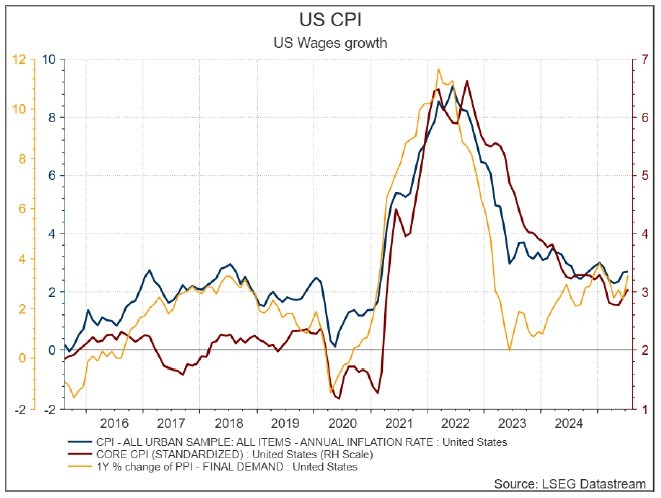

The US bond market was awoken from its delirium last week by the surge in the core PPI data. The index showed a 0.9% increase in July made of:

- Services 1.1%.

- Goods 0.7%.

This lifted the 12-month PPI to an increase of3.3% from its June 2.4% reading.

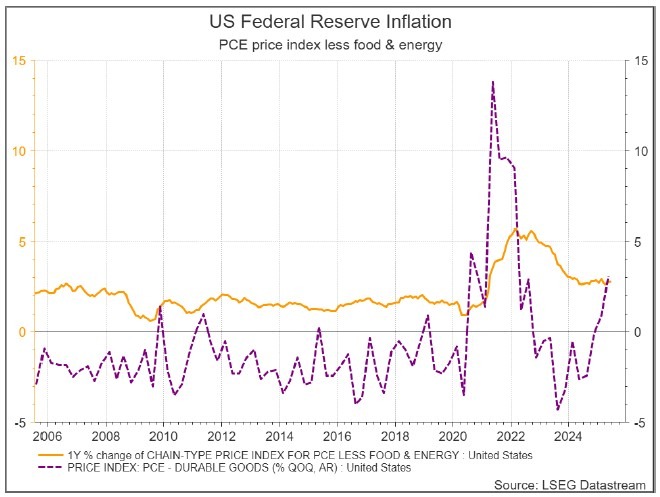

The message was that, in aggregate, companies are passing the tariff impact onto consumers. Combining the CPI and PPI data we can draw an early indication of what core PCE prices are doing. This is the Federal Reserves preferred inflation measure (on a quarterly not monthly basis) The CPI and PPI data last week indicate a 0.26% increase in core PCE prices in July, and this would lift the annual rate from the 2.8% in June to 2.9% in July. Our expectation is that by the end of September core PCE prices will be closer to 3.4% still. One of the drivers of this increase will be the impact of the tariffs that are really only coming into effect from August 8th but there is also the weakness in the USD since April that will drive up goods prices. This is more evident in durable goods prices that are surging.

If the Federal Reserve bends to political pressure and cuts rates this year it will trigger a sharp fall in the USD in much the same way it did in 1987. At some point investors will lose confidence in the value of assets priced in USD’s and begin selling. This will initially punch up long bond yields sharply and it this then translates into an equity market meltdown there will be an economic slowdown that will flatten the yield curve.

RBA is not Santa Claus, but the RBA interest rate Setting Board wants to be

We expect that the RBA Interest rate setting board will leave rates on hold now for the rest of the year for much the same reasons we do not believe rate cuts should have occurred at all this year. The reasoning is:

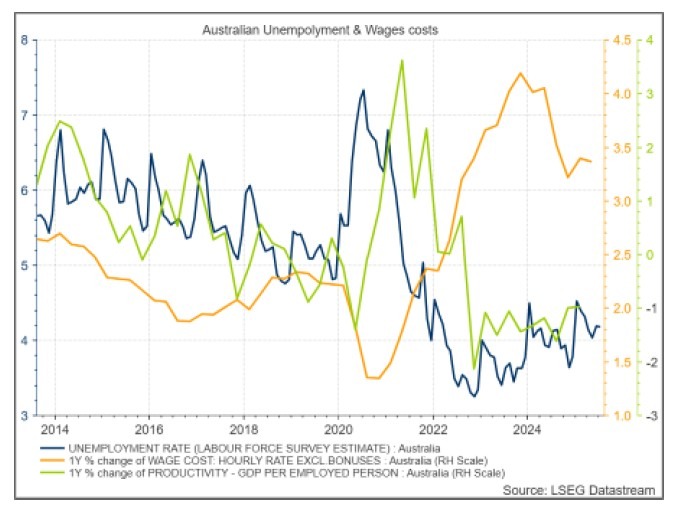

- With an unemployment rate of 4.2% the economy is operating well below the full employment unemployment rate of 4.75%.

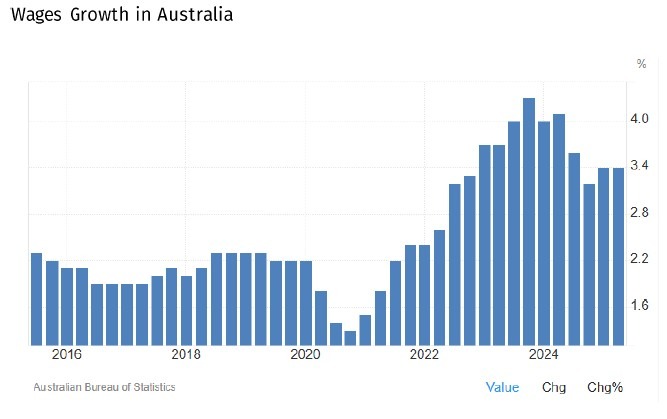

- Wages growth has been underwritten at 3.5% by the recent FWC decision in May.

- Labour productivity is negative (-1.0%) and this is why there is now a government push at the August Summitt to lift productivity.

- At a time of full employment all the State and Federal Budgets are still expansionary.

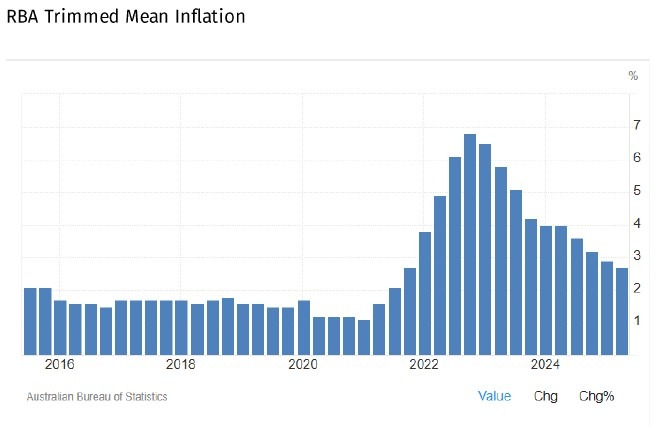

- Inflation has fallen steadily over the past 9 months but much of this is due to the electricity subsidies at state and federal levels that have now expired.

- The financial sector is stable & underwritten by rising property prices and loan arears at extremely low levels.

At a more specific level goods inflation is falling and may fall further in August given the strength of the AUD in the June quarter and the length of the inventory cycle, it is services inflation that remains stubbornly high. There is little scope in the forward data for education and healthcare prices to fall and we expect that annual increases in insurance premiums will now see financial services prices begin to rise (after the fall over the past 6 months due to competition).

What the new RBA Interest Setting Board should have been saying is:

- Inflation has only reached the target level of 2.5% (the band is no more) due to the electricity subsidies.

- Aggregate demand is still exceeding aggregate supply due to expansionary government budgets.

- The economy is operating well beyond full employment.

- The risks are skewed to wages growth igniting inflation again given the negative level of labour productivity.

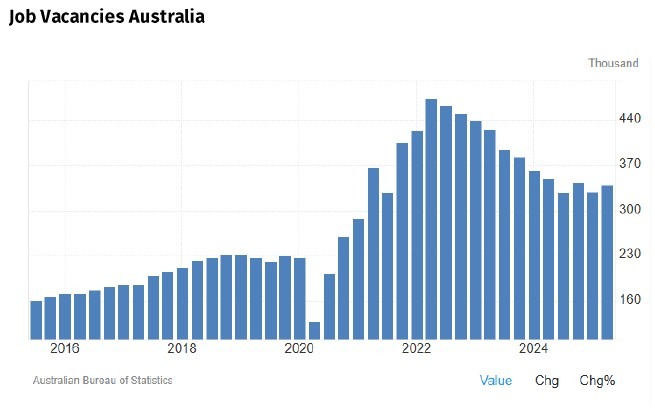

- Now add to this the fact that labour demand is very strong as indicated by the Jop Vacancies data.

US market commentators are fond of using job vacancies to determine the underlying strength of the employment market. lfwe used it an Australian context then the employment market looks very strong with job vacancies increasing to 339k in the second quarter having averaged 136k from 1979 to 2025.

The Transitory Butterfly is now history.

I do not know what is more disappointing.There are 4 esteemed economists on the RBA interest setting committee that, using a crayon on a large piece of white paper, should have been able to explain that wages growth is already inconsistent with inflation remaining below 3% over the next 12 months and that the negative 1.0% labour productivity results to date suggest it could begin to surge again. More alarming would have been that anyone of the four economists actually thought another rate cut was a good idea.

RBA interest rate setting board game theory.

Assuming then that the three ALP appointees that we calculate voted for a rate cut at the July meeting (Wilkinson, Ross and Marnie Baker) were joined by Alison Watkins whose terms ends in February 2026 and is on the board of Wesfarmers, this swung the pendulum to a rate cut and the rest of the board fell behind the independent/non-academic majority because they believe that the board should show solidarity. Going forward we do not expect another rate cut this year even if the RBA goldilocks forecast materialises. There will still be the 3 ALP appointee rate cut votes at each meeting, but we see Watkins moving to hold status until her term expires in February. If, as expected, another ALP acolyte replaces Watkins, we may really see the independence of the RBA interest setting board being greatly diminished. Welcome to a replay of the 1980’s!

Implications

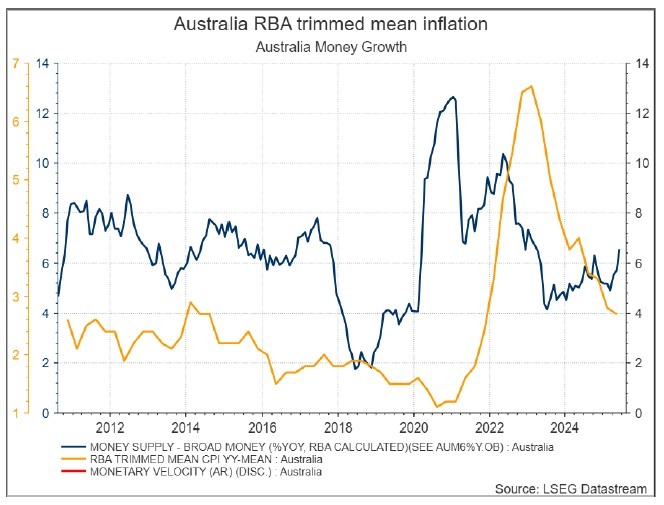

There are implications now from the RBA interest setting board (RISB) cutting rates and they are not pleasant. We already have broad money growth running at over 6%. Indicators of Inflationary Pressure

While we ceased measuring money velocity in 2012 it had been declining since the GFC in much the same way it was in the US. If it now begins to rise again (like it is in the US) due to the major banks switching back into business lending after three decades of preferencing residential asset lending, then monetary theory would predict higher inflation, but even without a measure of money velocity we can see in the chart below the relationship between money supply growth and inflation. If this relationship was not a fact, then the RBA would not bother adjusting money supply growth to tame inflation. It is really, really hard to rationalise the RBA thinking another rate cut was needed with broad money growing at 6% pa.

With a 2-quarter lag we are highly likely to see wages growth of 3.4% begin to push up inflation, even before we adjust for the electricity subsidies expiring. Cost push inflation is the next phase of this economic cycle. Even the RBA’s goldilocks 12-month forecast of unemployment at 4.3%, RBA trim med Mean inflation at 2.5% is predicated on labour productivity rising from the current negative 1.0% to positive 0.9% (where it averaged in the decade before the pandemic). Does anyone see this as remotely possible? Clearly, we would not be having a Productivity Summit in Canberra this week if fixing productivity will be easy. It is much more likely that we will have policies emerge from this summit that further damage labour productivity as there have been representations made by various interest groups that have included:

- A wealth tax that will destroy private business investment in Australia. The government will not care as it is already funding government entities like the National Reconstruction fund and the Clean Energy Fund to effectively invest in selected businesses to create State Owned Enterprises in place of private investment. The link between private business and labour productivity is very strong so the only real way to improve productivity is to enact policies that increase business investment. TheACTU knew th is in the 1980’s, remembered it in the 1990’s, became forgetful in the 2000’s and abandoned it with Kevin Rudd for its version of State-owned capitalism after the GFC.

- A 4-day working week and extra public holidays lodged by the ACTU based on a global study of 238 businesses where employees were asked ‘how the shorter working made them feel’ instead of actually measuring if output per worker actually increased.

The gap between labour productivity and wages growth in the chart below is the largest since the 1970’s.

Japan

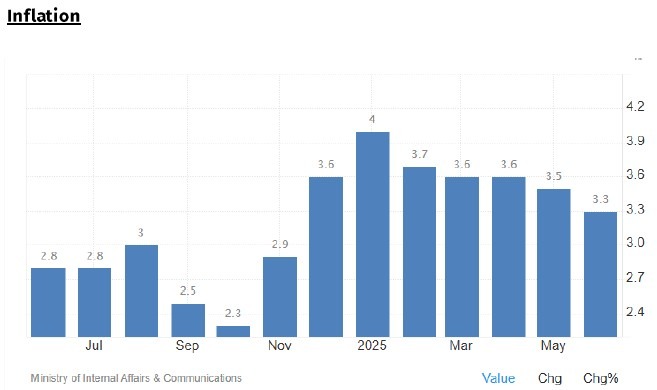

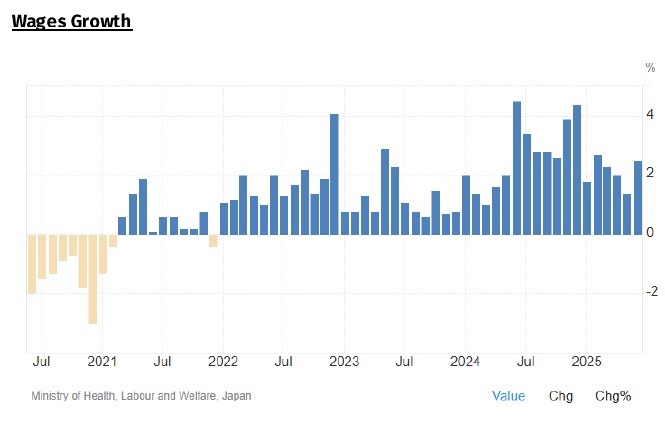

Contrast the political RBA interest setting board with the Bank of Japan where Governor Ueda has justified holding back another rate increase because wages growth remains stuck in aa 2-3% band since 2022 with inflation in a 3-4% band.