It is worth remembering, that economic forecasts from the RBA and the major banks that inflation will keep falling, are from the same economists that did not predict that inflation would rise in 2022. Arculus was then one of the few lone voices in the forest pointing out from late 2020 that all the ingredients were in place for an inflationary breakout. We believe that inflation will begin rising again in the 2H 2025 and this time reach a higher peak. When performing critical analysis of the RBA approach to Monetary Policy which does not appear to involve much economics but a great deal of politics, it is often useful to do a comparison to other central banks and their economic outcomes.

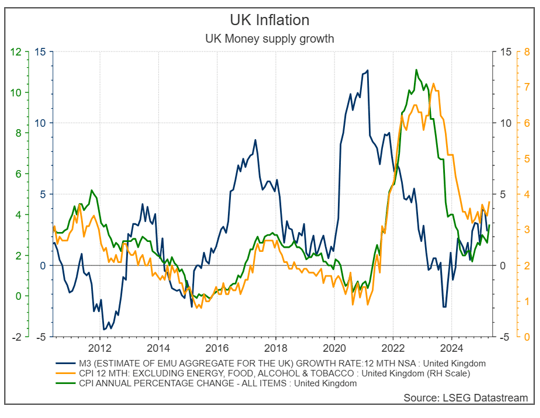

Firstly, the UK is once again recording increased inflation levels. Another reminder that inflation is a rolling stone that gathers moss!

In the UK there is a correlation between rising money supply and rising inflation. Money supply growth since mid-2024 is now fuelling a rise in prices that will not be upset by the rise of the Pound to the USD because there is very limited trade with the US.

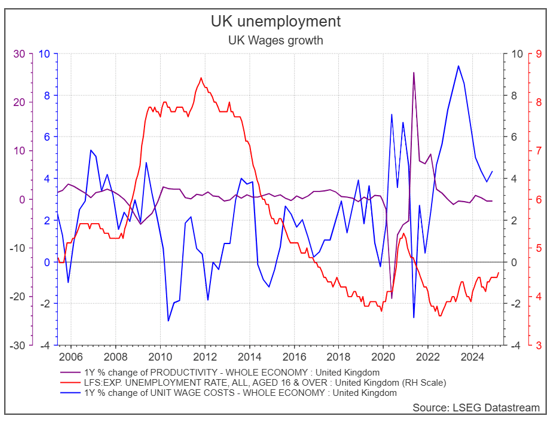

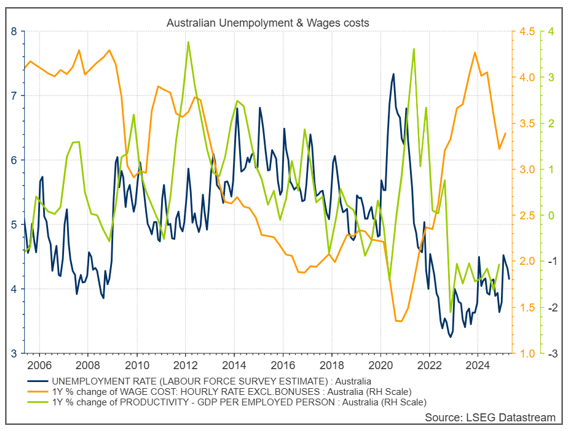

The recent rate cuts by the BOE reflect the degree to which unemployment has risen rather than the actual level. Some economists believe that every time the unemployment rate rises by 50bps it triggers a recession – because that is what has happened in the past. We would argue that the pandemic and Brexit distorted the employment readings, but that there is – with only a small lag- a correlation between the unemployment low points near 3.6% in late 2020 and late 2022 and a surge in wage costs 3-6 months later. We would argue that the UK is operating currently beyond full employment and that is why wages growth is above 4% while labour productivity is marginally negative (-0.302%).

In summary:

- Money supply growth conducive to rising inflation (MV=PQ).

- Wages growth > 4% not consistent with inflation falling sustainably back to 2% when labour productivity negative.

- Inflation is beginning to rise again in the UK.

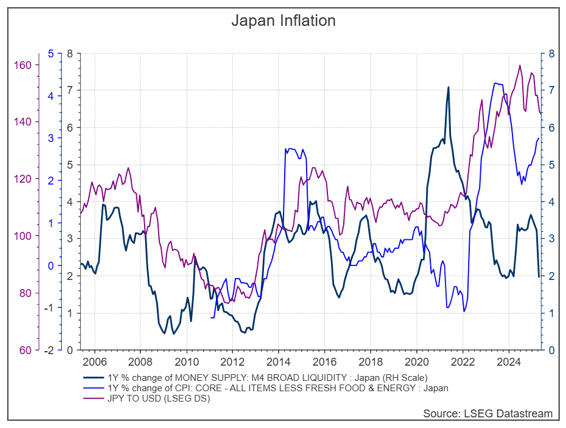

Secondly, Japan where it is the Yen weakness driving inflation primarily. Japan imports a lot of its inputs to its manufacturing sector so is vulnerable to a change in the exchange rate. Core inflation in Japan is once again increasing quickly, and this is driving bond yields in Yen higher. It could be easily argued that the BOJ does not need to tighten Monetary Policy again as broad money growth has declined considerably.

On the basis of Keynesian theory it could also be argued that the BOJ does not need to move rates higher again:

- Wages growth 2.13%

- Labour productivity INCREASING by 1.028%

- Unemployment rate is low but needs to be viewed in the context of Japan falling population number.

When will the Australian Housing Ponzi Scheme burst? When an external shock causes the first recession since 1992. A sustained economic contraction in Australia of more than 2 quarters is highly likely to result in a depression because it will take at least a decade to pay down government and household debt levels (far above those of the US currently). This is an economy living on borrowed time. Borrowed from our children that will face the burden of the debt, not the baby boomers that are now in retirement.

What we are reading

- Global bond market: Cracks in US and Japanese debt mean investors must question their long-held beliefs about the global economy

- Bond markets: How the US and Japanese turmoil could hit global markets (and your stock portfolio)

- Japan inflation climbs at fastest rate in more than 2 years

- The Japanese government bond market is in trouble

- Japan’s long-term borrowing costs hit record high on demand fears

Interest Rates

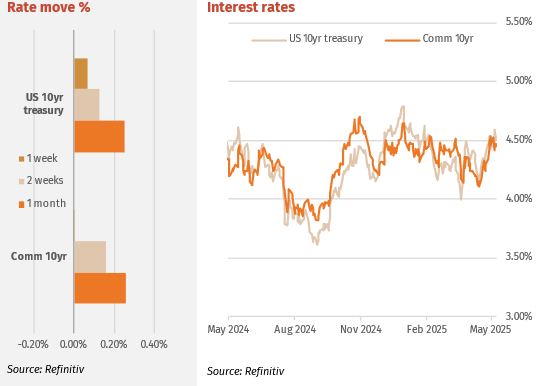

The US 10-year bond yield spiked higher to 4.632% early last week after the treasury 10-year auction failed to see the usual level of demand from offshore. 2-year bond yields were not impacted but will probably also see yields forced higher when Bessant is forced to rely on short, dated bonds (less duration risk so more Bank demand) to finance the government debt growth. It is important to keep some perspective here on US bonds. Despite inflation receding throughout 2024 and in fact official rate cuts occurring, the 10-year yield has been fairly stable in a range of 3.80-4.55% throughout this period.

Globally rates are under pressure, rises in Japanese long bond rates will have global impact on rates, plus inflation rises in Canada and the UK have increased these countries long bond rates in recent weeks.

The key 10-year Comm. Gov. bond yield tracked higher with US bonds for a weekly high of 4.51% but finished the week in NY at 4.38%. This discount to the US 10 year may be the result of funds flowing out of USD into AUD in the short term.

Major Credit Markets

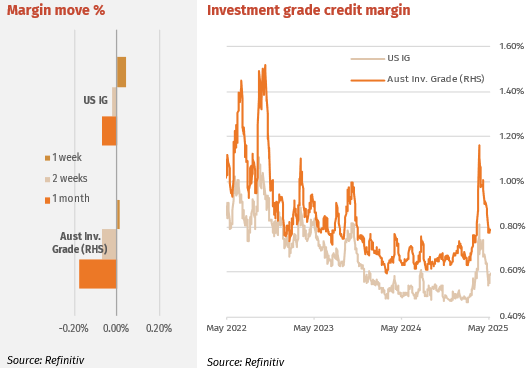

Credit markets weakened on the back of rising long bond yields, concern over the US’s credit rating and Trumps tariff threats to Europe. Margins ticked up a few points across the credit curve. Additionally, Trump’s tax-cutting bill weighed on credit sentiment. Cyclically exposed sectors have recovered in Investment Grade (IG) credits.

Senior bank bond credit spreads remained unchanged for the week however bank sub notes rallied across the maturity curve by 3-5 pts. There were only two credit deals of note last week. The Lloyds Senior 6NC5 year bond was issued at +155bp for $400m. The Macquarie Bank (MBL) issued $1.25bn Tier 2 split between 10NC5 and 15NC10 tranches. The 10NC5 FRN tranche priced very tight at +185bps.

High Yield Markets

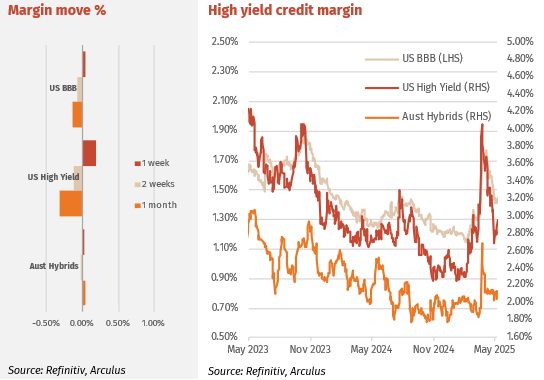

As mentioned above, credit markets weakened at week end especially in high yield (HY). BB and B rated companies moved 6 pts wider on Friday. CCC rated moves 10 pts wider. IG credit outperformed HY by 6 pts. Average high-yield spreads have fallen below levels recorded before the Trump tariffs on April 2. As a result, issuance levels have soared, with companies issuing bonds again before another disturbance takes place.

Hybrid markets were weaker last week with the average major bank hybrid margin moving wider by 3 pts despite a mid-week rally. Most weakness was at the short end with hybrids less than 2.5 yrs. to maturity widening in margin. As a result for the week, most of the volume was at the shorter end. In the non-majors, most hybrids were wider in spread except mot Macquarie and Suncorp issues.

Nufarm head stock was off nearly 40% for the week after a softer profit number and flagged sale of one of their two seed businesses. NFNG fell 7.61% to $85.00 which offers a 9.82% unfranked cash yield.

Listed Hybrid Market

Hybrid Margins and the cash rate

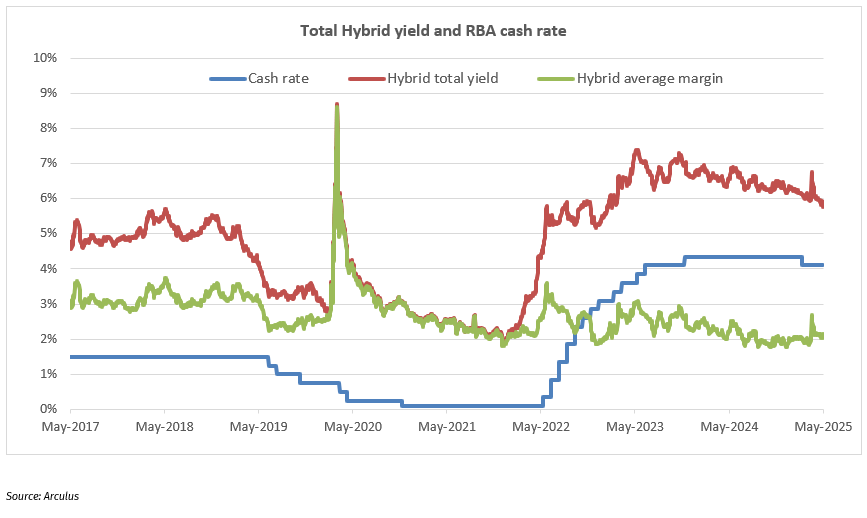

The RBA cut the cash rate last week by 0.25% to 3.85%. Total yield on hybrid securities—the combination of the cash rate and the hybrid margin—will decline. This is because hybrid yields are partly based on the variable bank bill rate, which closely tracks the cash rate. The 0.25% cut will reduce the total yield by the same amount. While the hybrid margin fluctuates daily and drives short-term yield movements, the cash rate exerts a broader and more sustained influence. The chart illustrates the RBA cash rate (dark blue) and the hybrid margin (green) since 2017. Their sum—the total yield—is shown in red and has closely followed changes in the cash rate, particularly during the sharp rate hikes between April 2022 and November 2023.

Forward Interest Indicators

Australian rates

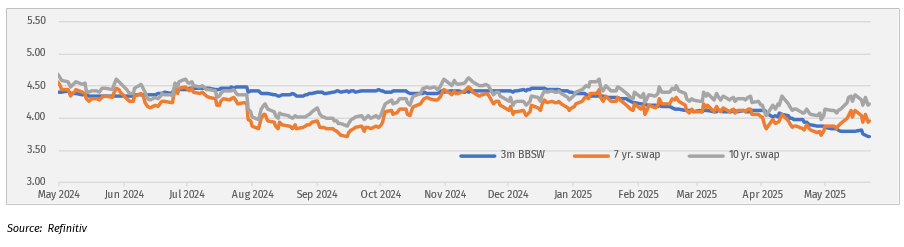

Swap-rates are volatile with bond rate moves.

Swap rates:

- 10-year swap 4.22%

- 7-year swap 3.97%

- 5-year swap 3.75%

- 1-month BBSW 3.74%