Just ahead of the anniversary of black Monday the markets had a little volatility last week with Trump threatening 100% new tariff on China disingenuously and at a far more serious level the ongoing impact of the First Brands collapse.

First brands collapse ensnares Jeffries. Milenium. UBS. Is it the canary in the coal mine?

The fear is that private credit is becoming a problem. One example is Tricolor, which is not a private credit fund, but its businesses was built on the same idea: Borrow money from banks, lend it to borrowers who don’t have access to bank financing-for a high yield. Plus, these bonds don’t trade in the public market, so their prices don’t swing day to day and they don’t have to reveal much information to the public. For these very reasons, investors have poured trillions of dollars over the past few years into private credit funds, which lend to small and midsize businesses that can’t raise capital from banks.

Few investors holding units in passive global credit funds will have realised that because First Brands debt was in the main credit indices, against which they benchmark, they have been damaged (at least to some extent) by this event. Jamie Dimon noted last week that there is never just one cockroach and so we may see more problems emerge soon. (Why Jamie Dimon is warning of ‘cockroaches’ in the US economy I CNN Business, ‘When you see one cockroach. there are probably more’: Jamie Dimon issues private credit warning I The Straits Times)

Then there will be the active credit fund managers that can earn performance fees for beating a benchmark. The performance fee will have biassed them to make higher risk for potentially higher return investments. One example here was the UBS private credit fund that held 30% weighting to First Brands. (UBSfunds and the insolvency of First Brands: A new Greensill debacle for investors? I LUTHER Rechtsanwaltsgesellschaft mbH). And then there are the active credit funds without a performance fee, but our lot are so large they end up having to buy most debt issues. Again because they are so large they are unable to do anything but a peripheral level of credit analysis on any one issuer even though they’re almost always public companies. And then there are the private credit funds where, almost always, financial information has to be provided by the issuer sending audited financial accounts annually and unaudited cash flow statements quarterly to the debt holders. Small private credit funds with fewer issuers will have the skills to perform and monitor the credit risk of their investments provided that they also accept a reasonable degree of concentration risk but those that claim to be low risk just because they hold a small percentage of any investment in anyone issuer, cannot possibly be doing the credit work on all their investments and so are going to have small but perhaps many (if a systematic risk event occurred like a recession) negative return outcomes.

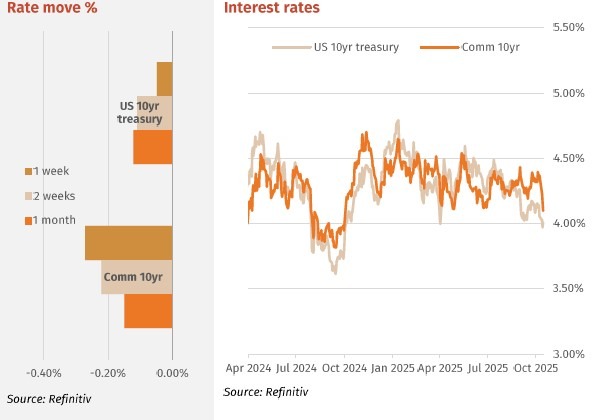

Interest Rates

Trumps update stance on China rescued what was looking like an ominous night on Friday. The US 10 year had traded well below key support at low as 3.93% in Asian trade but closed in New York at 4.01%.

Volatility over the week was driven by concerns about US bank credit exposures flowing from the first brands issue. The US 2-year fell from 3.51 to 3.47% over the week. A substantial further falling in yields is less likely now that the Federal Reserve has stopped quantitative tapering.

Post the slightly weaker employment data in Australia the 10-year bond fell from 4.375 to 4.10% and the 2-year fell from 3.54% to 3.28%. Notably the 2-10-year spread is still at 82bps indicating that the market still believes that the last RBA rate cut into an outlook where inflation increases, was a mistake. The markets have convinced themselves that a rate cut in November is almost certain due to the employment growth number in September being just 5000 jobs less than expected. The next inflation reading will be the real test for the RBA.

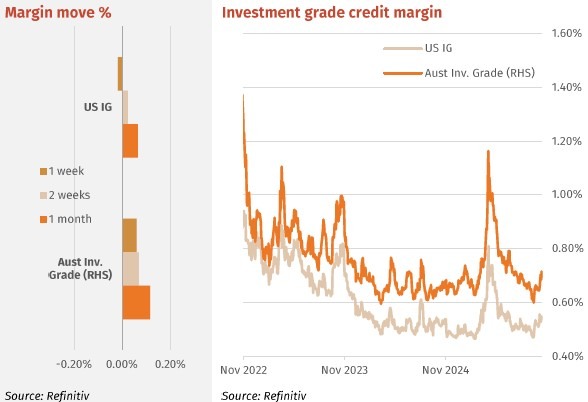

Major Credit Markets

Corporate bond spreads moved wider for the second week in a row, last week on the news flow re First Brands and Tricolor defaults/frauds. These defaults haven’t (so far) sparked a full-blown credit market crisis, but they have triggered heightened concern and tighter conditions in certain corners of the credit markets, the events triggering concerns about underwriting and collateral quality in private credit and leveraged-finance markets. Many investors are reviewing loan portfolios more closely, especially loans with opaque collateral or off balance-sheet structures. Very high-grade bond credit was hardly impacted, the US iTraxx index only widened by 1 point to finish the week at 0.538%.

Australian credit moved wider last week with the iTraxx index up by 0.05%, as case of US credit sneezes, Australian credit catches a cold, for no real reason except relative value. The successful issue of $450m Lend Lease Tier 1 securities last week would have been a big relief for Lend Lease senior bond holders.

High Yield Markets

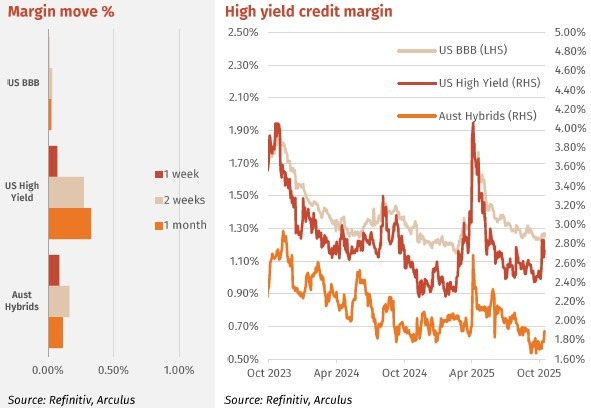

Specifically, the collapse of First Brands – which involved opaque financing, off-balance-sheet obligations and significant losses for lenders – has led to mark-downs in some credit portfolios and increased caution among high-yield/leveraged loan investors. In the high-yield (HY) bond market, while there has not (yet) been a large jump in defaults directly tied to these two companies, investor concern has increased noticeably. When such events occur, scrutiny increases. At week end two banks Zion and Western Alliance recognised credit losses/troubles tied to specific borrower groups/funds, which signal stress in certain credit channels. HY index credit spreads jumped as shown.

Hybrid volumes were elevated last week with the average major bank hybrid rising by 0.11% to 1.89%. NAB and ANZ were the most active traded with volumes well above weekly averages especially in NABPG, NABPH ad AN3PI. In contrast CBA and WBC issues mostly traded in line with weekly averages.

Listed Hybrid Market

ASX Hybrids

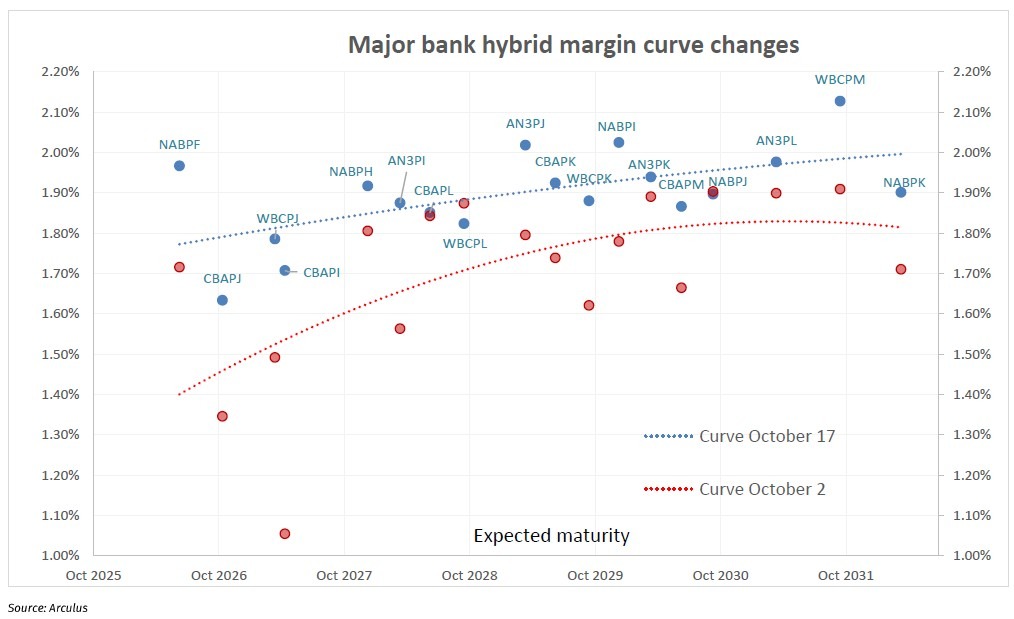

October so far hasn’t been kind to hybrids. As mentioned above, the average major bank hybrid margin widened last week. The recent low was October 2nd with the average just below 1.70%. Now it is 1.89% some 20 pints wider. The chart below shows the moves across the curve. The blue dots are the most recent margins with each issue labelled. The red dots are each issues’ corresponding margin at October 2. Most margins have risen with some substantial jumps especially at the short end – NABPF, CBAPJ, CBAPI and WBCPJ in particular. There are a few examples of steady margins: CBAPL, WBCPL, AN3PK and NABPJ. Otherwise most mid-range and longer dated hybrids have moved wider by about 0.25-0.30%. WBCPM offers the best value in the sector at a margin of 2.12%.

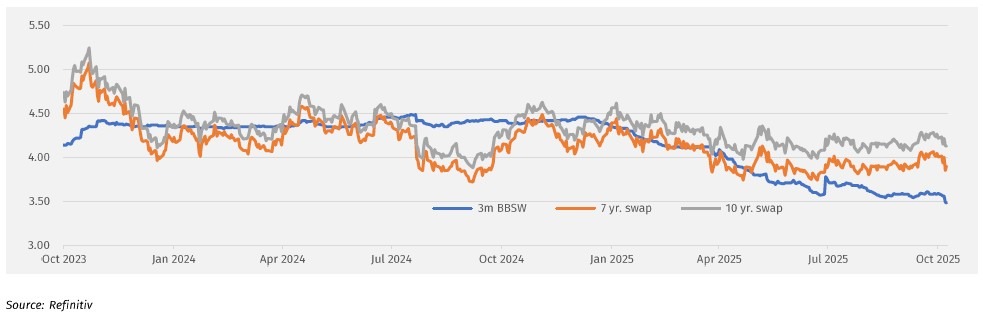

Forward Interest Indicators

Australian rates

Swap-rates fall with large falls in bond rates.

Swap rates:

- 10-year swap 4.13%

- 7-year swap 3.90%

- 5-year swap 3.73%

- 1-month BBSW 3.47%